2026 Auto Finance Risk: What Rising Payments and Longer Terms Mean for Lender Operations

Heading into 2026, most lender teams already know the macro narrative: affordability is tight, borrowers are stretched, and credit performance is uneven. But the real story inside most shops isn’t a chart in a quarterly deck—it’s the operational drag that shows up when portfolios get even slightly shakier.

When a few more accounts roll late, servicing queues fill up, recovery teams get more “where is the car?” work, vendors generate more touches, and exceptions multiply. You don’t just get more risk—you get more work per account.

Below are the trends worth watching in 2026, and the practical playbook lenders can use to reduce cycle time, rework, and loss severity.

Photo courtesy of TransUnion

2026 isn’t just a credit story—it’s an operations story

Auto debt continues to sit near record levels. The New York Fed reported auto loan balances at ~$1.67T in Q4 2025, with the flow into serious delinquency (90+ days) for auto loans roughly flat year-over-year (2.96% → 2.95%).

That “flat” line can be misleading operationally. Aggregate stability often hides segment-level stress—and operationally, segment stress is what blows up queues.

Trend 1 — Payments are still heavy, even when prices ease

Affordability improved slightly at the start of 2026, but the payment burden remains high relative to income.

Cox Automotive’s Vehicle Affordability Index update (Jan 2026) noted:

Typical payment ~$756

Average new-vehicle price ~$49,191

Estimated average auto loan rate ~9.52%

Meanwhile, Edmunds’ Q4 2025 data shows how quickly high payments become a structural risk:

Average new-vehicle payment hit $772 in Q4 2025

About 20% of new-car buyers had payments of $1,000+

84-month (or longer) loans reached 20.8% of new-vehicle financing

Why ops should care: payment strain doesn’t just increase delinquency risk—it increases volatility. The accounts you assumed were “fine” can roll late faster after a small disruption (hours cut, medical bill, insurance increase). That volatility is what drives more inbound calls, more promise-to-pay churn, and more accounts slipping into recovery queues.

Trend 2 — Delinquency signals are mixed overall, but subprime pressure is real

At the household level, the New York Fed’s Q4 2025 snapshot suggests auto serious-delinquency flow is broadly steady.

But in subprime, multiple sources point to elevated stress:

Reuters reported that Fitch data showed subprime auto ABS 60+ day delinquencies at 6.65% in October 2025 (a record in that dataset).

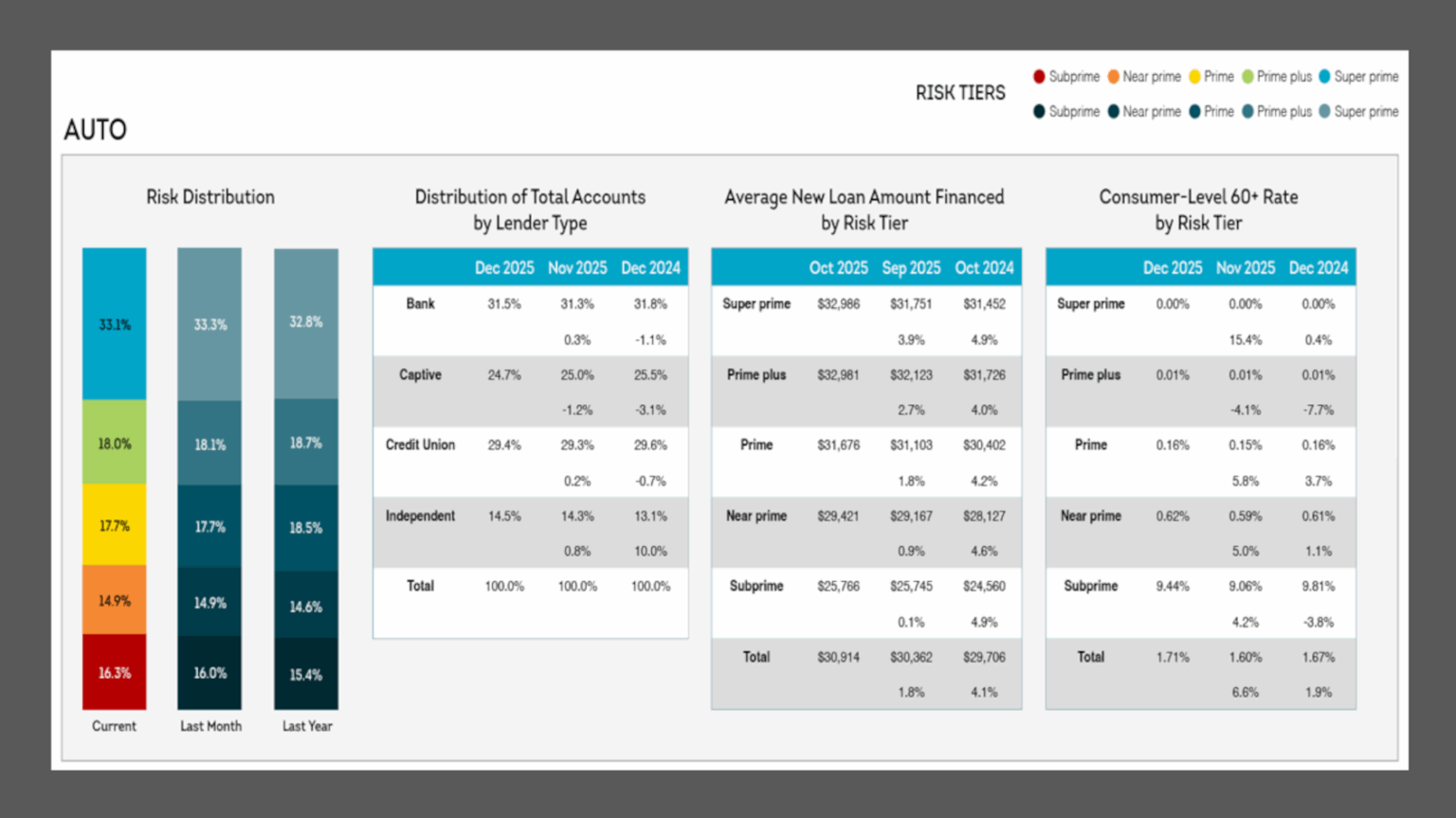

Auto Remarketing’s summary of TransUnion’s monthly snapshot also described YoY increases in 30+ and 60+ delinquency rates and detailed risk-tier mix. (Trade publication—useful directional context, but I still prefer primary reports when accessible.)

Why ops should care: even when top-line delinquency is stable, subprime stress drives disproportionate operational cost:

higher contact attempts per cure,

more skip activity and vendor touches,

more disputes/exception paths,

and more cases where basic facts (location, custody, impound status) are unclear.

That’s where “risk” becomes expensive: not only in losses, but in labor hours, vendor spend, and cycle time.

Trend 3 — Longer terms push risk later (they don’t remove it)

Longer terms are now normal—and that changes the risk timeline.

A LendingTree analysis based on a large sample of consumers with active auto loans found:

47.5% had loan terms longer than 72 months

7.6% had terms longer than 84 months

Edmunds’ Q4 2025 data aligns directionally: 84+ month loans are a meaningful share of new-vehicle financing.

Why ops should care: longer terms usually mean borrowers spend more time “upside down,” especially if the vehicle depreciates faster than the loan amortizes. That can increase loss severity when recoveries happen later in the lifecycle. Edmunds also reported 29.3% of trade-ins were underwater in Q4 2025, with average negative equity $7,214.

What this means for lender operations (servicing → recovery → remarketing)

This is the operational pattern I’d expect more lenders to see in 2026:

More exception handling

Not just “more accounts,” but more accounts that don’t move cleanly through the workflow.More verification work

Teams spend time re-checking custody, impound status, addresses, and vendor notes because data is fragmented.More vendor touches, more duplicate work

One team triggers a vendor action while another team works the same file from a different system.Higher loss-severity risk

Negative equity + timing + remarketing variability means every extra day matters more.

Put simply: you don’t need more alerts—you need fewer unknowns.

2026 playbook — What lenders should do now

If you want to reduce operational risk this year, focus on actions that remove rework and shorten verification loops:

Tighten segmentation + triggers

Separate “likely-to-cure” from “needs intervention now.”

Make triggers consistent across servicing, recovery, and remarketing (no competing rules).

Build a “verified facts” workflow

Define what must be verified before escalation (location/custody/impound confirmation where applicable).

Route files based on verification status—not just delinquency status.

Reduce exception paths

Track your top 10 exception reasons and eliminate the repeatable ones (missing data, wrong handoffs, duplicate vendor actions).

Standardize handoffs

One owner per stage.

Clear definitions of “ready for recovery,” “ready for remarketing,” and “ready to close.”

Measure what actually drives cost

Recovery cycle time

Verified location/custody rate

Vendor touches per recovery

Exception rate per 100 accounts

Loss severity by segment (and by time-to-action)

Audit negative equity exposure

If negative equity is climbing, assume higher loss severity and design earlier intervention strategies for the riskiest segments.

What to do next

Pick 25 accounts from the segments you expect to be hardest in 2026 and map the real workflow (systems touched, vendors used, time spent verifying basics).

Identify the two biggest verification bottlenecks and eliminate them first.

Put a simple weekly scorecard in place: cycle time, exceptions, verified facts rate, vendor touches.

If you want a quick starting point: use a one-page “Recovery Ops Readiness” checklist and benchmark your current process against it.

Sources:

Household Debt Balances Grow Modestly; Early Delinquencies Level Out for Non-Housing Debts

New-Vehicle Affordability Improves in January on Higher Income, Lower Loan Rates

Falling Underwater on a Car Loan Is Becoming More Common and Expensive Than Ever

Record number of subprime borrowers miss car loan payments in October, data shows

Auto Loans by Generation: Balances, Payments, Interest Rates and More